Miami Multifamily Memo | 2023 Year End Update

2023 is behind us.

Let's dig in. **if you’d like this data broken out by Miami Dade, Broward, & Palm Beach County, please reach out via email for the excel** Most headlines will point out that transaction volume is down roughly 60%, year-over-year. However, as predicted in my 2023 mid-year update, South Florida is back to a pre-pandemic average number of deals traded (82 vs. 87) and sales volume closed ($3.14B vs. $3.28B), highlighted above. The only difference being that the price per unit was +50% more in 2023 than 2019 ($212K/door vs. $318K/door). Why? Because rents have grown 50 - 100% since. So where do we go from here? As the uptick of new supply begins to deliver and loan maturities start coming due, my guess is in 2024 and 2025 we'll start averaging:

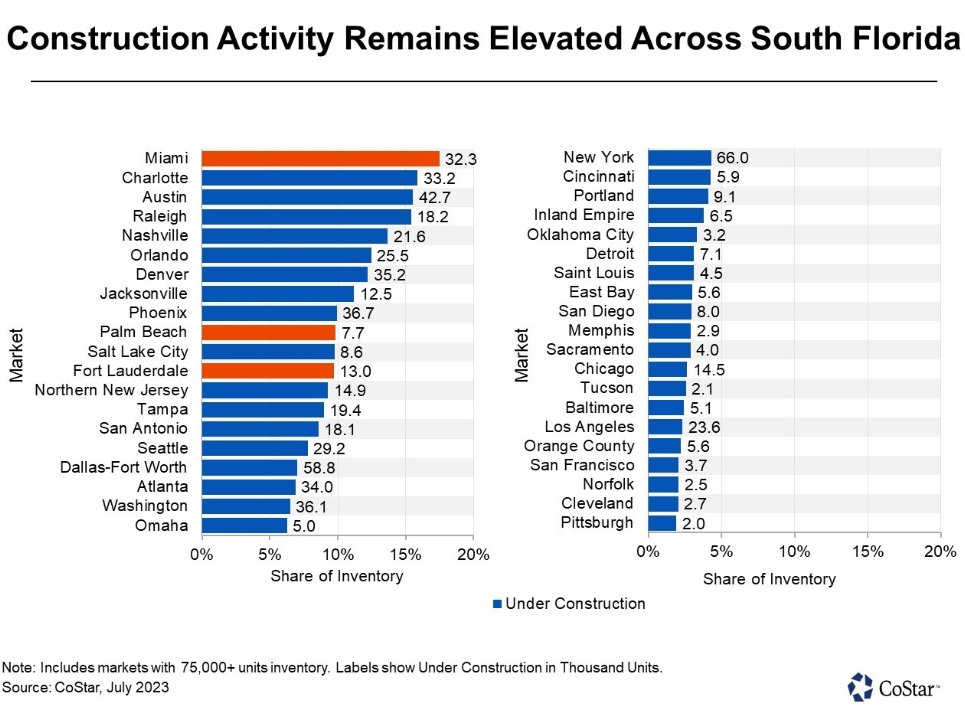

I like to keep these memo's short, so I'll leave you with the most bullish chart for the transaction activity coming to South Florida:

Construction activity means deals will be delivering and need to be sold, recapitalized, or refinanced (i.e. capital events). How this may hinder rent growth will vary by submarket, which I will get into as I start sharing "submarket reports" starting February. In a nutshell, however, once you fast forward 3, 5, 7 years from now, Miami will continue dominating capital and migration patterns as we offer an even better value proposition for current and future residents alike as one of the most dense, rewarding, and feasible cities in America. Virtuous cycles. long MIA -Omar Morales Just Closed2024 is off to a good start! Here are some stats of last week's trade:

Latest Podcast Episode:Navigating Miami's Condo Crisis: Purchasing, Terminations, & Insurance with David Podein I'll be sharing submarket specific data and recent trades in the next issue. P.S. Berkadia is hosting a happy hour event at NMHC in San Diego this Tuesday evening. If you've read to the bottom of this memo, you've earned your invite! Email me for details. |

1111 |

Miami Multifamily Memo

Realtime multifamily insights and opportunities from one of the most active Land & Multifamily brokers in South Florida (+$3.3 billion closed & counting ! )

Interview with CEO Tere Blanca The Woman Leading Miami's Office Market Watch Now Subscribe to Youtube About Tere Blanca Tere Blanca is the Founder, Chairman, and CEO of Blanca Commercial Real Estate, Florida’s leading independent office advisory firm. Founded in 2009, the firm has grown to more than 50 professionals across three Southeast Florida offices and has sustained approximately 30% market share of Miami’s Class A and B office lease transactions since 2016. In this episode, Tere shares...

Omar Morales Our team is working on roughly ~$375,000,000 dollars-worth of active listings so far in the first quarter of the year. Most of the opportunities are condo / multifamily development land listings and some are existing multifamily properties. Below are just a few. Feel free to reach out for more. The next newsletter will include a market update and some commentary from me. Multifamily Listings Opportunity To Acquire A 108-unit Value-Add, Garden-style Property in Deerfield Beach...

Miami Multifamily Memo Why you should not buy Multifamily in Miami right now Why you should not buy Multifamily in Miami right now: Cap rates are ~5% Debt is +6%. expense inflation Insurance has been a problem Supply wave in certain pockets Why you should: There are few buyers today. Most groups are net bearish, waiting for “a reckoning” Multifamily properties that traded for ~$400K/unit in 2022 are now trading for ~$300K/unit. The cost to build those assets have gone from ~$250K/unit to...